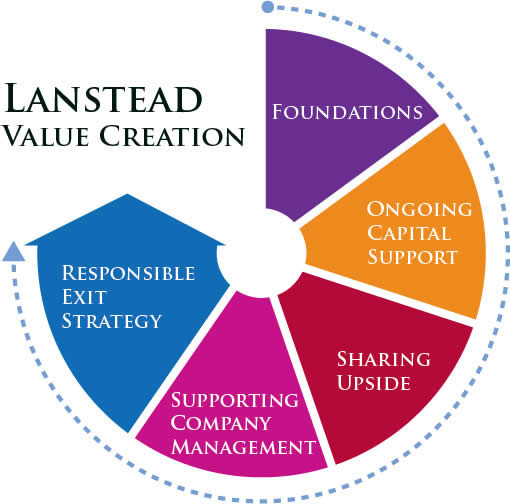

Lanstead is focused on providing supportive, longer term capital that rewards growth. We invest to make a difference in a company’s future.

There are a number of ways a business can raise capital; however, these can often be costly with either interest rate charges or the loss of large portions of ownership. At Lanstead, we believe there is a better way. Our unique financing model is designed to share the upside in company growth in a way unavailable through generic debt and equity financings. We partner with companies and their brokers & advisers in support of company growth.